gilno.ru Learn

Learn

Which Mortgage

Explore the best mortgage lenders — a list that spans banks, credit unions and online companies — and learn how to optimize the shopping process. Some banks and other lenders (including individual counties and cities in Minnesota) offer special mortgages for first-time homebuyers. Explore the top mortgage lenders and land down payments as low as 0% to 15%. Find the perfect home loan lender with Forbes Advisor. What Is A Mortgage? · A mortgage is a loan from a lender that gives borrowers the money they need to buy or refinance a home. The borrower agrees to pay back. The Which? mortgage lender reviews combine customer ratings with our own expert analysis to reveal the best and worst mortgage providers out there. Because life is meant to be enjoyed. Northern specializes in mortgages for seasonal properties and second homes. While a year mortgage will result in a lower monthly payment, it will end up more costly cumulatively when compared to the year mortgage. This is because. Which mortgage providers use VantageScore? Lenders that issue Fannie Mae and Freddie Mac-funded mortgages, which make up the vast majority of residential. From conventional to government-backed loans, there's a mortgage for almost any situation. Compare the best mortgage lenders for your homebuying needs. Explore the best mortgage lenders — a list that spans banks, credit unions and online companies — and learn how to optimize the shopping process. Some banks and other lenders (including individual counties and cities in Minnesota) offer special mortgages for first-time homebuyers. Explore the top mortgage lenders and land down payments as low as 0% to 15%. Find the perfect home loan lender with Forbes Advisor. What Is A Mortgage? · A mortgage is a loan from a lender that gives borrowers the money they need to buy or refinance a home. The borrower agrees to pay back. The Which? mortgage lender reviews combine customer ratings with our own expert analysis to reveal the best and worst mortgage providers out there. Because life is meant to be enjoyed. Northern specializes in mortgages for seasonal properties and second homes. While a year mortgage will result in a lower monthly payment, it will end up more costly cumulatively when compared to the year mortgage. This is because. Which mortgage providers use VantageScore? Lenders that issue Fannie Mae and Freddie Mac-funded mortgages, which make up the vast majority of residential. From conventional to government-backed loans, there's a mortgage for almost any situation. Compare the best mortgage lenders for your homebuying needs.

Obtain estimates from loan officers at banks and credit unions, as well as mortgage brokers and non-bank lenders. Tip 3: Compare loans on the same day. Because. The vast majority of mortgages are either conventional loans or government-insured loans. Conventional mortgages are not part of a specific government program. Here, learn about the four most common types of mortgage lenders — and what to do if you're still feeling uncertain about which to choose. From great, low rates to options with no down payment required, we have the right mortgage to fit your needs. Government-backed loan options, such as FHA, USDA and VA loans, are typically the easiest type of mortgage to get because they may have lower down payment and. Explore the top mortgage lenders and land down payments as low as 0% to 15%. Find the perfect home loan lender with Forbes Advisor. Mortgage loans generally fall into one of two broad categories — fixed-rate and nonfixed-rate. Fixed-rate mortgages feature a nonchanging interest rate. Use this free mortgage calculator to get a side-by-side view of multiple loan quotes to select the best offer. For each quote you can select different rates. Apply for your mortgage or refinance online with loanDepot. Trust the second largest non-bank lender in the country to provide you with quality mortgage. A mortgage can typically be as long as 30 years and as short as 10 years. Short-term mortgages are considered mortgages with terms of ten or fifteen years. Long. Understanding Common Types of Mortgage Loans · Fixed-Rate Mortgage: This mortgage type has an interest rate that stays the same for the life of the loan. When you look at the amortization schedule for your loan, you'll see exactly how each payment will get split between principal and interest. By using the loan. Compare types of mortgages to find the best for you. Use our mortgage payment calculator to get an estimate of your monthly payment. An adjustable rate mortgage (ARM) is a type of loan for which the interest rate can change, usually in relation to an index interest rate. Discover our mortgage calculators to find the best rates from lenders across Canada. Which Mortgage is the only independent Canadian mortgage advice. Whether you want to learn how mortgages work or are actively searching for a deal, our mortgage guides will help you find the best solution for your needs. What mortgage rates is everyone getting? Currently got % with credit score. I think I need to keep shopping around. Use our mortgage calculators to calculate a mortgage payment, compare loans, find out how much house you can afford, and more. A fixed-rate mortgage is exactly what it sounds like: a home loan with a mortgage interest rate that stays the same for the entire loan term. Determining which mortgage term is right for you can be a challenge. With a shorter year mortgage, you will pay significantly less interest than a.

Track A Phone Without Touching It

![]()

Through find my device application, one can locate android phone with simply tapping Ring My Phone tab in a dialog which appears when user click on phone. Measure your heart rate · On your phone, open the Google Fit app Google Fit. · At the bottom, tap Home. · Scroll to “Heart rate” and tap Add Add data. · Touch and. 4 Ways to Track My Phone for Free Online with Ease ; Google Find My Device, Android Device associated with a Google account ; iCloud Find Devices, Apple Device. Pegasus, the military-grade phone tapping software recently in the news for tracking journalists, was installed remotely on iPhones and Androids without. It is possible to track a cell phone without installing anything using services like Google's Find My Phone, Apple's iCloud, Samsung's Find My Mobile, and more. Cellphone surveillance may involve tracking, bugging, monitoring, eavesdropping, and recording conversations and text messages on mobile phones. You can track it without touching it by asking them to turn on location sharing for you. They might not do it, but then again, they might. The truth is that, yes, your phone can be tracked. Sometimes unsavory characters will find ways to hack into your device to see where you're going. Other times. Here are the most common warning signs that your phone is being tracked, tapped, or monitored by spyware software: Anomalous data usage. Through find my device application, one can locate android phone with simply tapping Ring My Phone tab in a dialog which appears when user click on phone. Measure your heart rate · On your phone, open the Google Fit app Google Fit. · At the bottom, tap Home. · Scroll to “Heart rate” and tap Add Add data. · Touch and. 4 Ways to Track My Phone for Free Online with Ease ; Google Find My Device, Android Device associated with a Google account ; iCloud Find Devices, Apple Device. Pegasus, the military-grade phone tapping software recently in the news for tracking journalists, was installed remotely on iPhones and Androids without. It is possible to track a cell phone without installing anything using services like Google's Find My Phone, Apple's iCloud, Samsung's Find My Mobile, and more. Cellphone surveillance may involve tracking, bugging, monitoring, eavesdropping, and recording conversations and text messages on mobile phones. You can track it without touching it by asking them to turn on location sharing for you. They might not do it, but then again, they might. The truth is that, yes, your phone can be tracked. Sometimes unsavory characters will find ways to hack into your device to see where you're going. Other times. Here are the most common warning signs that your phone is being tracked, tapped, or monitored by spyware software: Anomalous data usage.

Measure your heart rate · On your phone, open the Google Fit app Google Fit. · At the bottom, tap Home. · Scroll to “Heart rate” and tap Add Add data. · Touch and. Spyware is a form of malicious software which can monitor your online activity without your knowledge. It can collect sensitive information about you, such as. Which means that once a criminal gets access to your phone, all your apps are open doors for cybertheft. If you lose track of your device out in public. Just enter the number you want to track to the relevant field, and Scannero will find it. No physical access to the target device is needed. What's more. Spying Apps: Utilizing spy apps is a popular way to monitor a phone without having direct access to it. These apps can provide access to call. Tracking someone's cell phone without their consent or without a legitimate reason is a violation of privacy and potentially illegal. Android Device Manager allows you to remotely locate, lock, and erase your phone. Touch Find My Device and turn it on. To learn more, touch > Help. Phone tracker by number free is your go-to app to locate lost phones and fulfill find my phone needs! Protect your family with our free precise live mobile. Mobile Phone Tracker - hidden tracking app that secretly records location, SMS, call audio, WhatsApp, Facebook, Viber, camera, internet activity. You might be able to use Find My Mobile or Smart Switch to back up your device, use a mouse or keyboard on your device, or connect to a TV or PC monitor. If you. This tracking app is designed to allow you to do remote monitoring without the person using the other phone knowing. It can only be achieved by ensuring that. mSpy is one of them. mSpy provides a powerful Call Logger, which gives access to the complete call history. With it, you can see all incoming and outgoing calls. Another really great spy feature that Qustodio offers is call and SMS monitoring. This lets you monitor your child's calls and messages and block or whitelist. Discover an effective parental control app. Learn how to track a phone with MoniMaster's advanced features, available on Android, iOS, WhatsApp, and iCloud. They can also install it themselves by getting physical access to your phone. without the consent of the user. Furthermore, those ads might be. To be able to monitor an Android mobile, regardless of the brand, without having to root the device, you must use spy apps. This method allows you to monitor. Part 1. How to spy on someone's iPhone without touching it · 3. mSpy. mSpy stands out as a top spy software, enabling remote tracking of the target iPhone. · 4. Top 6 apps to track your husband's phone without touching it · 1. Sign up for free. We'll set you up with your own Spynger account and you'll be ready to monitor. Through find my device application, one can locate android phone with simply tapping Ring My Phone tab in a dialog which appears when user click on phone. Hacks happen when bad actors — such as hackers, cybercriminals, or even friends — access your phone or your phone's data without your permission. While phone.

Ing Digital Bank

The digital asset evolution is fast and so is the terminology. In this video, we explain the two categories of digital assets and the concept of. ING is a trusted and well-known global bank. With their mobile-first approach, they combine seamless digital banking and personalised support. As a bank, we support our customers in their sustainable transformation – whether business customers or private customers. German arm of ING Bank creates new Welcome initiative to increase digital services for prospective and existing customers. “Customers rightly expect more from their bank in terms of digital interactions and ease of managing their finances, this trend will continue to define the bank. ING Bank primarily focused the ATF strategy on the digitalisation of ING's practices. An investment of € million in digital transformation over the period. Their services include internet banking, mobile apps, social media and direct messaging. ING Bank's ambition was to reach a clear number one position in the. ING are a global bank with a strong European base, serving large Discover the fintech and digital banking stars of tomorrow · Download the TMI. In this short video, we explain the two categories of digital assets and the concept of tokenization. We also cover five key advantages we have identified with. The digital asset evolution is fast and so is the terminology. In this video, we explain the two categories of digital assets and the concept of. ING is a trusted and well-known global bank. With their mobile-first approach, they combine seamless digital banking and personalised support. As a bank, we support our customers in their sustainable transformation – whether business customers or private customers. German arm of ING Bank creates new Welcome initiative to increase digital services for prospective and existing customers. “Customers rightly expect more from their bank in terms of digital interactions and ease of managing their finances, this trend will continue to define the bank. ING Bank primarily focused the ATF strategy on the digitalisation of ING's practices. An investment of € million in digital transformation over the period. Their services include internet banking, mobile apps, social media and direct messaging. ING Bank's ambition was to reach a clear number one position in the. ING are a global bank with a strong European base, serving large Discover the fintech and digital banking stars of tomorrow · Download the TMI. In this short video, we explain the two categories of digital assets and the concept of tokenization. We also cover five key advantages we have identified with.

Global transformation of ING Bank with an end-to-end portfolio lifecycle approach Otherwise, register and sign in. Comment. Related Content. Digital products. German arm of ING Bank creates new Welcome initiative to increase digital services for prospective and existing customers. ING launches 3 digital banking features in Q1 ING Bank is improving its digital capabilities and offerings as it posted growing mobile. Our twimbit analyst team highlights how ING Bank- Australia offers a range of value-added products to create an omnichannel banking journey. All the banking solutions you are looking for are at ING! Click for our special advantageous loans, deposits, investment products and other services. Isa pa nmn sila sa nagcocompete sa number 1 digital bank na CIMB. I mean few years ago it was only them na nag operate. Will slowly pull out my. The future of the bank branch Despite recent advancements in digital banking, traditional bank branches are far from obsolete - in fact. Sixty-nine percent of Retail Banking customers contact the Bank exclusively via digital channels. ING therefore pursues a digital-first approach, but. ING introduced the concept in other countries in as ING Direct, a bank without branches that offered attractive savings accounts and other retail banking. Dutch bank ING is proud of its track record in innovating to improve the Digital banks continue to lead UK banking satisfaction · Digital journeys. Digital banking services · Be in full control with InsideBusiness · Interactive channels · Connectivity channels · Trade solutions · Finance your trades and. The ING Group (Dutch: ING Groep) is a Dutch multinational banking and financial services corporation headquartered in Amsterdam. Its primary businesses are. ING is a pioneer in digital banking and on the forefront being one of the most innovative banks in the world. As ING we have a clear purpose that represents our. Built over 70 wholesale banking workflow solutions in Pega. Launched fully digital client onboarding experience. Streamlined experience for wholesale clients. Inventing the digital future for our customers · Risk Management. The hunt for 'detectives' · Wholesale Banking ING Hubs providing services to ING units all. It has been a privilege providing you with the smart, easy, and personal banking choice. For all the love and support you've shown us, we thank you from the. The future of the bank branch Despite recent advancements in digital banking, traditional bank branches are far from obsolete - in fact. ING Bank primarily focused the ATF strategy on the digitalisation of ING's practices. An investment of € million in digital transformation over the period. ING | followers on LinkedIn. Empowering people to stay a step ahead in life and in business. | ING is a pioneer in digital banking and on the. Wholesale Banking & Generic Services. Advisory Channels. Customer Interactions. Digital Tribe. What's remarkable when joining the Digital Tribe as an IT.

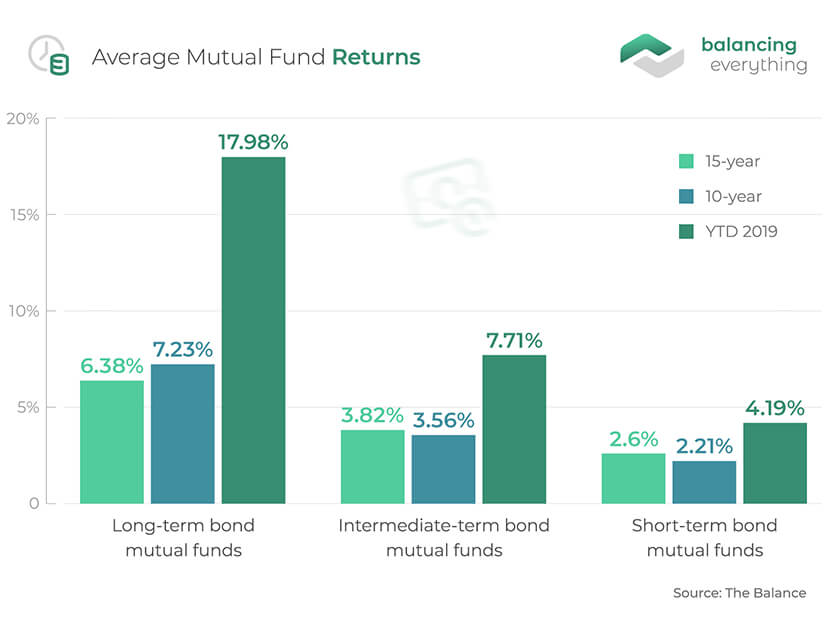

Average Mutual Fund Cost

As you might expect, fees and expenses vary from fund to fund. A fund with high costs must perform better than a low-cost fund to generate the same returns for. This fee is becoming less often incorporated into funds but is still worth noting as the advisor compensation portion can be between % annually. While. *As of December 31, , Vanguard's average mutual fund and ETF expense ratio is %. Industry average mutual fund and ETF expense ratio: %. All averages. The MER is expressed as an annualized percentage of daily average net asset value during the period. For example if a fund's MER is %, this means the fund. For mutual funds that invest in large U.S. companies, look for an expense ratio of no more than 1%. And for funds that invest in small or international. ETFs: Index funds sponsored by ETF companies (many of which also run mutual funds) charge only one kind of fee, an expense ratio. It works the same way as it. For example, if you have $10, in a mutual fund with a % expense ratio, you're paying about $50 per year in expenses. Where to look it up? Schwab mutual. Mutual fund fees and expenses ; Municipal Bond, %, % ; Alternative, %, % ; Commodities, %, % ; All funds, %, %. fee, operating expenses and taxes charged to a fund during a given year expressed as a percentage of a fund's average net assets for that year. All mutual funds. As you might expect, fees and expenses vary from fund to fund. A fund with high costs must perform better than a low-cost fund to generate the same returns for. This fee is becoming less often incorporated into funds but is still worth noting as the advisor compensation portion can be between % annually. While. *As of December 31, , Vanguard's average mutual fund and ETF expense ratio is %. Industry average mutual fund and ETF expense ratio: %. All averages. The MER is expressed as an annualized percentage of daily average net asset value during the period. For example if a fund's MER is %, this means the fund. For mutual funds that invest in large U.S. companies, look for an expense ratio of no more than 1%. And for funds that invest in small or international. ETFs: Index funds sponsored by ETF companies (many of which also run mutual funds) charge only one kind of fee, an expense ratio. It works the same way as it. For example, if you have $10, in a mutual fund with a % expense ratio, you're paying about $50 per year in expenses. Where to look it up? Schwab mutual. Mutual fund fees and expenses ; Municipal Bond, %, % ; Alternative, %, % ; Commodities, %, % ; All funds, %, %. fee, operating expenses and taxes charged to a fund during a given year expressed as a percentage of a fund's average net assets for that year. All mutual funds.

The holdings of the mutual fund are known as its underlying investments, and the performance of those investments, minus fund fees, determine the fund's. Typical fund expenses include investment management, distribution, recordkeeping, custodial, legal, and accounting fees. When added together, the sum of these. For actively managed mutual funds: ; Rs , %, % ; Rs 10,, %, % ; Rs 10, 50, Actively managed mutual fund investors pay an average of % in annual fees, as described below. Fee, Arithmetic Average, Detail of Average Calculation, Asset. Get our US Fund Fee Study to learn what the latest average expense ratios and US mutual fund fee trends mean for your clients' portfolios. Anything under 50 bps is cheap in the mutual fund and ETF universe. Upvote. Most ETFs have low expenses compared to actively managed mutual funds. ETF expenses are usually stated in terms of a fund's OER. The expense ratio is an annual. Management Fees: These include portfolio management fees and trailing commissions. · Operating Costs: These cover the mutual fund's accounting, audit costs and. Learn more about the average cost basis method of selling shares and get tax answers at H&R Block. Without any annual fees, the $, investment grew to just over $, over 20 years. A % annual expense ratio reduces your end value by around $30, For example, say the average expense ratio across the entire fund industry was %. This would equate to $47 for every $10, invested. If an expense ratio. Use the “Custom” tab to try out your own numbers for returns and fees. You can also compare your results to past average returns for mutual funds by asset class. Some funds may have an annual marketing or distribution fee, generally –1% of the fund's net assets. Other expenses. Fees which cover other costs of. Most funds in the sample with management fee breakpoints, however, have assets above the last breakpoint. 2. Summary of Recommendations. We believe that the. Currently the typical expense ratio for an actively managed mutual fund is about %, and that number has been going up lately. With an expense ratio of %. “ RIA Industry Study: Average Investment Advisory Fee Is %.” RIA in a Box, 18 June , gilno.ru For mutual funds that primarily hold equities, costs are significantly greater for retail shares. Annual expenses for median retail shares were percentage. Mutual fund costs vary by share class, and are most commonly classified as Class A, B or C shares, although many employer retirement plans include Class R. Add up the cost of all the shares you own in the mutual fund. · Divide that result by the total number of shares you own. This gives you your average per share. Management or investment advisory fees – these fees go toward paying fund managers and range on average from to %. 12b-1 distribution fee – this fee.

Compare Retirement Accounts

9 types of retirement accounts · Key takeaways · (k) · (b) and (b) · Pension · Traditional IRA · Roth IRA · Rollover IRA · Roth (k). Traditional & Roth IRAs. Assets have the potential to grow tax-deferred with various contributions and withdrawals guidelines. · Rollover IRA Consider your. Those seeking to benefit from tax-free earnings1 may choose a Roth IRA. Compare traditional and Roth IRAs to learn more about your options. Use this table to see a side-by-side comparison of traditional and Roth IRA features and benefits. 1 IRA and (k) accounts let you save for retirement with tax benefits. 2 Employers may match your contributions but limit your investment choices. An Individual Retirement Account, commonly called an IRA, is also a kind of tax-advantaged account for retirement savings. But unlike (k) plans, they are not. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. Compare our small-business retirement plans. Vanguard SEP-IRA (One person) Plan sponsors and participants Individuals who are self-employed or earn freelance. Roth IRA contributions are made with after-tax dollars. Traditional, pre-tax employee elective contributions are made with before-tax dollars. Income limits. No. 9 types of retirement accounts · Key takeaways · (k) · (b) and (b) · Pension · Traditional IRA · Roth IRA · Rollover IRA · Roth (k). Traditional & Roth IRAs. Assets have the potential to grow tax-deferred with various contributions and withdrawals guidelines. · Rollover IRA Consider your. Those seeking to benefit from tax-free earnings1 may choose a Roth IRA. Compare traditional and Roth IRAs to learn more about your options. Use this table to see a side-by-side comparison of traditional and Roth IRA features and benefits. 1 IRA and (k) accounts let you save for retirement with tax benefits. 2 Employers may match your contributions but limit your investment choices. An Individual Retirement Account, commonly called an IRA, is also a kind of tax-advantaged account for retirement savings. But unlike (k) plans, they are not. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans. Compare our small-business retirement plans. Vanguard SEP-IRA (One person) Plan sponsors and participants Individuals who are self-employed or earn freelance. Roth IRA contributions are made with after-tax dollars. Traditional, pre-tax employee elective contributions are made with before-tax dollars. Income limits. No.

Retirement plans exist for employees, the self-employed and small-business owners. The best options offer a variety of investment options with low fees. Find the right retirement plan for your small business at T. Rowe Price by comparing the features and requirements of different plans side-by-side. Comparing the Plans: Investment Plan and Pension Plan. For complete plan Traditional retirement pension plan. It is designed for employees who are. We'll cover employer-sponsored plans, individual retirement accounts, and plans for self-employed individuals and small business owners. Help take the guesswork out of which plan could be right for you with a 5-minute quiz · Explore our plans · Compare plans · Watch a video · Explore our plans. This is a comparison between (k), Roth (k), and Traditional Individual Retirement Account and Roth Individual Retirement Account accounts. Compare IRAs vs. (k)s to discover which retirement account makes the most sense for you and make sure you're saving in a tax-advantaged way. Fidelity investments. Typically, there are no limits on moving funds between investment options or to another active provider within the USC plan. However. Traditional retirement plans can be IRAs or (k)s. These tax-deferred retirement plans allow you to contribute pre-tax dollars to an account. With a. Retirement Accounts You Should Consider · (k) · Solo (k) · (b) · (b) · IRA · Roth IRA · Self-Directed IRA · SIMPLE IRA. Individual retirement accounts (IRAs) are retirement savings accounts with tax advantages. · Types of IRAs include traditional IRAs, Roth IRAs, Simplified. Is a Roth IRA conversion right for you? Answer a few quick questions and see next steps, depending on your personal situation and financial goals. Here's a guide to the various types of retirement accounts you might use and how each one fits into your taxes. The most crucial difference between an IRA and a (k) is that a (k) is a workplace retirement plan. An IRA is something you typically get on your own. Including a non-working spouse in your plan increases your social security benefits up to, but not over, the maximum. Compare savings accounts with the best. Fidelity investments. Typically, there are no limits on moving funds between investment options or to another active provider within the USC plan. However. Robust retirement plans with a variety of investments can help you reach your retirement savings goals. Find out which options are right for you. The best retirement plan to build your nest egg will depend on your financial situation, your goals for retirement, and other factors. Comparisons are based on Nationwide® (b) and (k) retirement plan data. Just enter your information below and you will see a snap-shot of where you stack.

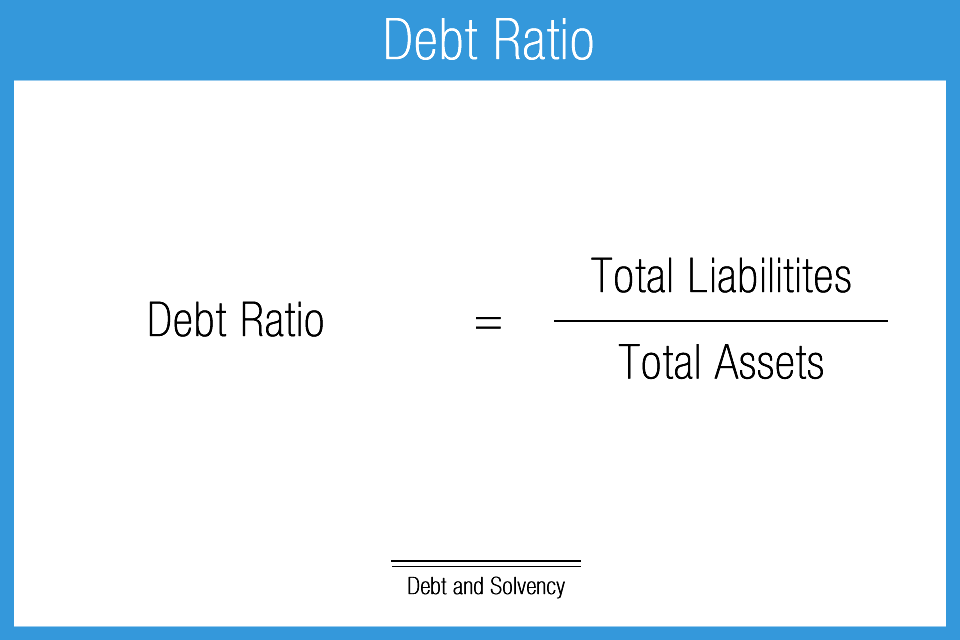

How To Get The Debt Ratio

How do you lower your debt-to-income ratio? Make a plan for paying off your credit cards. Increase the amount you pay monthly toward your debts. Extra. This article will help you calculate your own DTI. This will be useful to you not only by determining your odds of being approved for a new loan. The debt-to-income ratio compares your income to your debts. A ratio higher than 40% could result in a lender refusing you a loan. To calculate the debt ratio, divide the total liabilities by the total assets. It is important to note that the low or high debt ratio depends on the particular. How to calculate your debt-to-income ratio · The housing to income ratio equals the sum of your monthly housing payment, divided by current income. · The back-end. What is the debt ratio formula? The formula is determined by dividing total liabilities by total total assets. Both values can be found in balance sheet. The. What is a good debt-to-equity ratio? Although it varies from industry to industry, a debt-to-equity ratio of around 2 or is generally considered good. This. The debt-to-equity ratio helps you determine if there's enough shareholder equity to pay off debts if your company were to face a decrease in profits. Key Highlights · Debt to assets is one of many leverage ratios that are used to understand a company's capital structure. · The ratio represents the proportion. How do you lower your debt-to-income ratio? Make a plan for paying off your credit cards. Increase the amount you pay monthly toward your debts. Extra. This article will help you calculate your own DTI. This will be useful to you not only by determining your odds of being approved for a new loan. The debt-to-income ratio compares your income to your debts. A ratio higher than 40% could result in a lender refusing you a loan. To calculate the debt ratio, divide the total liabilities by the total assets. It is important to note that the low or high debt ratio depends on the particular. How to calculate your debt-to-income ratio · The housing to income ratio equals the sum of your monthly housing payment, divided by current income. · The back-end. What is the debt ratio formula? The formula is determined by dividing total liabilities by total total assets. Both values can be found in balance sheet. The. What is a good debt-to-equity ratio? Although it varies from industry to industry, a debt-to-equity ratio of around 2 or is generally considered good. This. The debt-to-equity ratio helps you determine if there's enough shareholder equity to pay off debts if your company were to face a decrease in profits. Key Highlights · Debt to assets is one of many leverage ratios that are used to understand a company's capital structure. · The ratio represents the proportion.

To calculate your DTI, add up all of your monthly debt payments, then divide by your monthly income.

As the name suggests, the debt-to-asset ratio or total-debt-to-total-assets ratio is a debt ratio of a company's total debts to its total assets, expressed as a. Debt ratio is the amount of assets compared to the amount of liabilities an organization has. Explore the overview of debt ratios, good and bad debt ratios. Here's the formula for debt-to-equity ratio analysis: Debt-to-equity ratio = Total Liabilities / Total Shareholder Equity. What happens if Alex marries Jordan? For the purposes of a shared mortgage, or for a couple's personal loan, their combined DTI ratio would be calculated by. Total liabilities will have to be divided by the company's total assets to obtain the debt-to-asset ratio. “We include current assets—. To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income — the total amount you earn each month before taxes. According to a breakdown from The Mortgage Reports, a good debt-to-income ratio is 43% or less. Many lenders may even want to see a DTI that's closer to 35%. Answer and Explanation: 1. The debt ratio is computed by dividing the total liabilities by the total assets. Both of these line items are subtotals presented on. To calculate your DTI, you can add up all of your monthly debt payments (the minimum amounts due) and divide by your monthly income. Then, multiply the result. The debt ratio is a metric that quantifies the proportion of a company's total liabilities against its total assets. A general rule of thumb is to keep your overall debt-to-income ratio at or below 43%. This is seen as a wise target because it's the maximum debt-to-income. To calculate your estimated DTI ratio, simply enter your current income and payments. We'll help you understand what it means for you. The Debt to Equity Ratio is a leverage ratio that calculates the value of total debt and financial liabilities against the total shareholder's equity. Hence, the formula for the debt ratio is: total liabilities divided by total assets. The debt ratio indicates the percentage of the total asset amounts (as. Debt ratio is a measurement that indicates how much leverage a company uses to finance its operation by using debt instead of its truly owned capital or equity. Debt-to-income ratio (DTI) is the ratio of total debt payments divided by gross income (before tax) expressed as a percentage, usually on either a monthly or. The debt-to-equity ratio is calculated by dividing the total payment obligations by the original investment into the company. When calculating the debt-to-. The debt-to-equity ratio (D/E ratio) depicts how much debt a company has compared to its assets. It is calculated by dividing a company's total debt by total. To find the debt ratio for a company, simply divide the total debt by the total assets. Total debt includes a company's short and long-term liabilities (i.e. It is essentially a measure of how much of an entity's assets are financed through debt and it is calculated by dividing the total debt by the total assets.

Local Advertising App

Using the audience parameters, I've been able to increase our sales with very limited and strategic use of location-based advertising. It's a good app. Keep it. Grow your business and increase sales with online advertising solutions that help you find, attract, and engage customers on and off Amazon. LOCALACT is the premier platform built to power and scale local digital marketing for franchise systems and multi-location businesses. local store. Drive sales with paid advertising. When you're ready, you can promote your products with Performance Max advertising campaigns to reach more. Radio – U.S. Stations. With over radio stations, only iHeartMedia can offer local activation with national reach. Individual station brands deliver the. Promote your app across Google's largest properties with App Campaigns. Discover how Ads can help you grow your base and get more mobile app installs. Nextdoor is a local social media platform that brings neighbors and businesses together. Instantly reach your most valuable customers — your neighbors. Find, convert and keep customers with LocaliQ's fully integrated growth marketing platform. Use Waze Ads to boost store visits with location-based advertising. Get your business in front of customers in a car nearby or searching on Waze. Using the audience parameters, I've been able to increase our sales with very limited and strategic use of location-based advertising. It's a good app. Keep it. Grow your business and increase sales with online advertising solutions that help you find, attract, and engage customers on and off Amazon. LOCALACT is the premier platform built to power and scale local digital marketing for franchise systems and multi-location businesses. local store. Drive sales with paid advertising. When you're ready, you can promote your products with Performance Max advertising campaigns to reach more. Radio – U.S. Stations. With over radio stations, only iHeartMedia can offer local activation with national reach. Individual station brands deliver the. Promote your app across Google's largest properties with App Campaigns. Discover how Ads can help you grow your base and get more mobile app installs. Nextdoor is a local social media platform that brings neighbors and businesses together. Instantly reach your most valuable customers — your neighbors. Find, convert and keep customers with LocaliQ's fully integrated growth marketing platform. Use Waze Ads to boost store visits with location-based advertising. Get your business in front of customers in a car nearby or searching on Waze.

Considered the best app for the city's local information, Public App is used in top cities and is available in 9 languages. Brands associated with the app will. Connect with more people in your area with ads on Facebook. You can advertise directly from your Facebook Page to promote your business locally. Just click or. apps installed on your device. This helps us show you local ads and other ads that you might prefer. X may also personalize ads based on information that X. Second, businesses can buy ad space that we show on sites and apps that partner with us, like news publications and blogs. In this case, most of the money goes. The sales, marketing and creative teams of NBCU Local help brands large and small access the world of NBCU innovation and offerings. Advertise on X to increase reach and sales. X helps you build awareness and drive conversions with effective ad formats and targeting tools. Nextdoor helps home services businesses harness the power of word-of-mouth marketing so you can reach where your customers are - online or in the Nextdoor app. Advance Local operates businesses spanning media,marketing and technology. We have a pure passion for people, innovation and a shared mission. App · Shopping · Video · Demand Gen · Display · Local Services Ads · Google Analytics · Keyword Planner · Manager Accounts · Google Ads Editor · Reach Planner. A specialized ad manager built for and praised by local news, city and regional magazines, industry journals, and any publisher than relies on direct sales. Boosting posts on the Instagram iOS app is now more expensive to account for Apple service charge. Use the web to avoid fees. Learn More. When people search on their mobile devices for nearby businesses on gilno.ru or Google Maps, for example, “coffee near me”, they may view local search ads. BuySellAds builds advertising solutions for publishers and marketers. Sell ads with powerful advertising technology, or buy ads that reach audiences at. Businesses get X more leads with Yelp Ads*. Reach more customers who are searching for local businesses like yours. Prominent display on search and. Microsoft Ads help you stay on top of your advertising campaigns while you're on the go Local Services ads by Google. Business. SEMrush. Business. Sign up for Microsoft Advertising. Use our search engine marketing and audience solutions to help you build your business. 3. Mobile Advertising · Mobile display ads · Mobile search ads · Mobile videos · Mobile app ads, which are meant to drive downloads of a brand's app · Social media. With Roku's connected TV advertising platform, you can reach more customers, drive more sales, and get creative that's built for streaming advertising. Grow your business and increase sales with online advertising solutions that help you find, attract, and engage customers on and off Amazon.

Stock Candle Reading

Candlesticks provide investors with instantaneous snapshots across whether a market's price movement has been positive or negative, and to what degree. As specified earlier, candlesticks are a way of presenting the price action over an established period of time. Moreover, they can provide useful information. Candlesticks give you an instant snapshot of whether a market's price movement was positive or negative, and to what degree. Candlestick patterns are tools used in technical analysis to interpret price movements in financial markets. Daily Candle offers different categories that talk about the world of trading and chart analysis. Each category provides different and complementary. In day trading, momentum is everything. On this token, the character of the candles can tell us if there is demand or if a stock is sleepy and uninteresting —. Candlestick trading graphically displays market sentiment. A close above an open indicates bullish market sentiment, and this is denoted by a green candle. Such. A candlestick is a single bar on a candlestick price chart, showing traders market movements at a glance. Each candlestick shows the open price, low price. I am interested in trading but I am new for it, I don't know how to read and interpret the candlestick on TradingView and it is my first time of using it. Candlesticks provide investors with instantaneous snapshots across whether a market's price movement has been positive or negative, and to what degree. As specified earlier, candlesticks are a way of presenting the price action over an established period of time. Moreover, they can provide useful information. Candlesticks give you an instant snapshot of whether a market's price movement was positive or negative, and to what degree. Candlestick patterns are tools used in technical analysis to interpret price movements in financial markets. Daily Candle offers different categories that talk about the world of trading and chart analysis. Each category provides different and complementary. In day trading, momentum is everything. On this token, the character of the candles can tell us if there is demand or if a stock is sleepy and uninteresting —. Candlestick trading graphically displays market sentiment. A close above an open indicates bullish market sentiment, and this is denoted by a green candle. Such. A candlestick is a single bar on a candlestick price chart, showing traders market movements at a glance. Each candlestick shows the open price, low price. I am interested in trading but I am new for it, I don't know how to read and interpret the candlestick on TradingView and it is my first time of using it.

A candlestick chart is a type of chart, as well as a technical tool, used to identify trading patterns in a currency pair. In this blog post, we'll break down 20+ of the most common candlestick chart patterns and explain what they indicate. Each candle represents the trading activity for whatever period of chart you are looking at on a stock, index, or other trading instruments. If its an hourly. The experienced traders of today understand that emotions and sentiments influence stock prices. A candlestick chart carefully analyzes these emotions and. This article will help you understand trader psychology and analyse candlestick chart patterns to trade in financial markets successfully. A candlestick chart is a technical tool for forex analysis that consists of individual candles on a chart, which indicates price action. You can also use a Screener to choose stocks with a specific candlestick pattern. What are Candlesticks? Let's start from the basics to see what trading signals. A candlestick chart is a technical tool for forex analysis that consists of individual candles on a chart, which indicates price action. Where a stock closes in relation to the range tells us who is winning the war between buyers and sellers. This is the most important thing to know when reading. Candlesticks have become a much easier way to read price action, and the patterns they form tell a very powerful story when trading. Japanese candlestick. Candlestick analysis focuses on individual candles, pairs or at most triplets, to read signs on where the market is going. A candlestick chart is a style of financial chart used to describe price movements of a security, derivative, or currency. Scheme of a single candlestick. The longer the body of a candlestick, the more the pressures for the stock to increase or decrease in price verses the opening price. A short bodied candlestick. Candlestick charts are a Japanese way of reading price action. Candlesticks were initially used for trading rice in the s and onwards. They are available. Inspect the upper shadow of the candlestick to determine the high price. The shadow is a line behind the body of the candlestick and is also sometimes known as. Solid candle if the current closing price is lower than the current opening price. · Hollow candle if the current closing price is higher than the current. The Candle chart consists of candle-shaped bars, or "candles". The top and the bottom sides of a candle indicate the high and the low prices registered on the. If you don't know how to read Japanese candlesticks, you will never be able to trade the market. Japanese candlesticks are the language of financial markets, if. 1. Hammer pattern: If you find a short candlestick body with a longer lower wick at the end of a downward trend, it indicates a strong buying surge. If the body. The candlestick is one of the most widely used charting methods for displaying the price history of stocks and other commodities – including.

Average Cost Of Car Payment

If we include the initial down payment of $4,, the total cost of the car would be $49, What Is the Average Interest Rate on a Car Loan if the Buyer. Take the time to research the average cost of the vehicle that interests you. Know its Kelley Blue Book value and the cost of add-ons, insurance, and other. The average monthly automobile payment in the United States is $ for a new car. · $ is the typical monthly automobile payment in the United States for a. While a used car typically costs less, it also has a lower overall value than a new car. What credit score do you need to get a car loan? A credit score of. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. For example, lower monthly loan payments often require longer terms and higher interest rates, which will substantially increase your overall cost. When. With our car payment calculator, you can quickly determine how much you'll owe the loan company each month. According to Kelly Blue Book, at the end of , the average new car costs more than $49,, and used cars average more than $26, in early · Spend no. Find Average Tax Rate and Fees in Your State. Amortization schedule. Month $0 $10K $20K $ If we include the initial down payment of $4,, the total cost of the car would be $49, What Is the Average Interest Rate on a Car Loan if the Buyer. Take the time to research the average cost of the vehicle that interests you. Know its Kelley Blue Book value and the cost of add-ons, insurance, and other. The average monthly automobile payment in the United States is $ for a new car. · $ is the typical monthly automobile payment in the United States for a. While a used car typically costs less, it also has a lower overall value than a new car. What credit score do you need to get a car loan? A credit score of. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. For example, lower monthly loan payments often require longer terms and higher interest rates, which will substantially increase your overall cost. When. With our car payment calculator, you can quickly determine how much you'll owe the loan company each month. According to Kelly Blue Book, at the end of , the average new car costs more than $49,, and used cars average more than $26, in early · Spend no. Find Average Tax Rate and Fees in Your State. Amortization schedule. Month $0 $10K $20K $

Use Ally's car payment calculator to estimate your ETF trading prices may not necessarily reflect the net asset value of the underlying securities. Try our car payment calculator to determine your monthly payments when financing a car fees that may be charged at the dealership. See results. Chase logo. Annual percentage rates for BMW Select or Owner's Choice are based on an average credit rating assessment. payment or trade was used as the net capital cost. Estimate your car payment or see how much car you should budget for. Consumer Loan Calculator. Compare Loan Calculations. Vehicle Model Year: Monthly Payment. The average monthly payment on a new car was $ in the second quarter of , according to credit reporting agency Experian. Leasing a new car was cheaper at. Because it's wise to keep your car payment, maintenance, gas, repairs, and insurance costs at or below 10% of your monthly take-home pay, you'll need to do some. Used car (dealer): Example: A 5-year, fixed-rate used car loan for $32, would have 60 monthly payments of $ each, at an annual percentage rate (APR) of. Average interest rates for car loans The average APR on a new-car loan with a month term was % in the first quarter of , according to the Federal. Select a vehicle to estimate monthly payments on your new Hyundai. This free tool acts like an auto loan calculator to help you determine finance options. The interest rate on this auto loan. Original loan term. The number of months over which you would repay this loan if you made your normal monthly payment. In Q2 , the average interest rate for a new car was % and % for a used car, according to Experian. When it comes to auto loans, most lenders use. Average ( - ) pay an annual registration fee to the town or city of your residence. Insurance: Car insurance is required by law and covers the cost. Average () The interest rate represents the cost of borrowing money, and a higher interest rate results in a larger monthly payment to cover the higher. Estimate your car payment or see how much car you should budget for. Consumer Loan Calculator. Compare Loan Calculations. Vehicle Model Year: Monthly Payment. Annual percentage rates for BMW Select or Owner's Choice are based on an average credit rating assessment. payment or trade was used as the net capital cost. Purchase Price: It is recommended that the monthly auto loan payment alone is limited to about 10% to 15% of your after-tax take-home pay. A lower purchase. Take the time to research the average cost of the vehicle that interests you. Know its Kelley Blue Book value and the cost of add-ons, insurance, and other. What Is a Good APR for a Car Loan? Interest on an auto loan can significantly increase the total cost of the car. For example, the interest on a $30,, Estimate your monthly car payment with our payment calculators. Ready to ** Estimated monthly payment may be inaccurate without title, taxes, and fees. With the Honda Payment Estimator tool, it's easier than ever to calculate monthly payments for financing and leasing options on new Honda models.